About FintruX

FintruX Network is a blockchain based online ecosystem connecting borrowers, lenders, and rated service agencies. FintruX facilitates marketplace lending in a true peer-to-peer network to ease the cash-flow issues of small businesses and startups.

THE CHALLENGE

The Issues Plaguing Traditional Financing- Significant Collateral Required

Banks like to loan cash on cash. This means that they will lend you the same amount of money you have in your savings account, using your money as collateral. This makes it difficult for businesses with low liquidity to get much needed capital to grow their business.

- Stringent Requirements

Traditional local banks and credit unions do offer unsecured loans. However, it is extremely difficult to get an unsecured business loan through traditional lenders; especially if your business is relatively young. It can take months to apply and few businesses rarely get approved.

- Impossible Rates and Terms

Less advisable financing options are often available, but these come with outrageous interest rates and unrealistic repayment schedules. Small businesses and startups should not have to choose between bankruptcy and borrowing under unclear, unfair and uncertain terms.

THE SOLUTION

FintruX Network makes it easy for small businesses to quickly secure affordable loans with no collateral, in any currency.

The three main competitive advantages of FintruX are:

Credit Enhancements

By applying credit enhancements, FintruX Network will virtually neutralize the lender’s credit risk and, in the case of a default, provide cascading levels of insurance to cover any possible loss. With risk reduced, lenders have peace of mind and the interest rates for borrowers is lowered.

LEVEL 1: Over-Collateralization

Covers 1 out of 10 bad loans

FintruX Network holds back 10% of each loan as over-collateralization for additional default protection. This serves as the primary level of security for lenders.

LEVEL 2: Third-Party Guarantors

Takes care of overflow losses

Individuals are invited to participate on the platform as a guarantor to the loans of their choice. Guarantors choose their risk & compensation packages, and in the case of defaults, cover the losses.

LEVEL 3: Cross-Collateralization

Covers multiple bad loans

The 10% held back from every loan is pooled together in a cross-collateralization pool which functions as an insurance to cover all loans within the same class. When invested properly to match the obligations, this pool can offer a sufficient coverage ratio against the average loan loss.

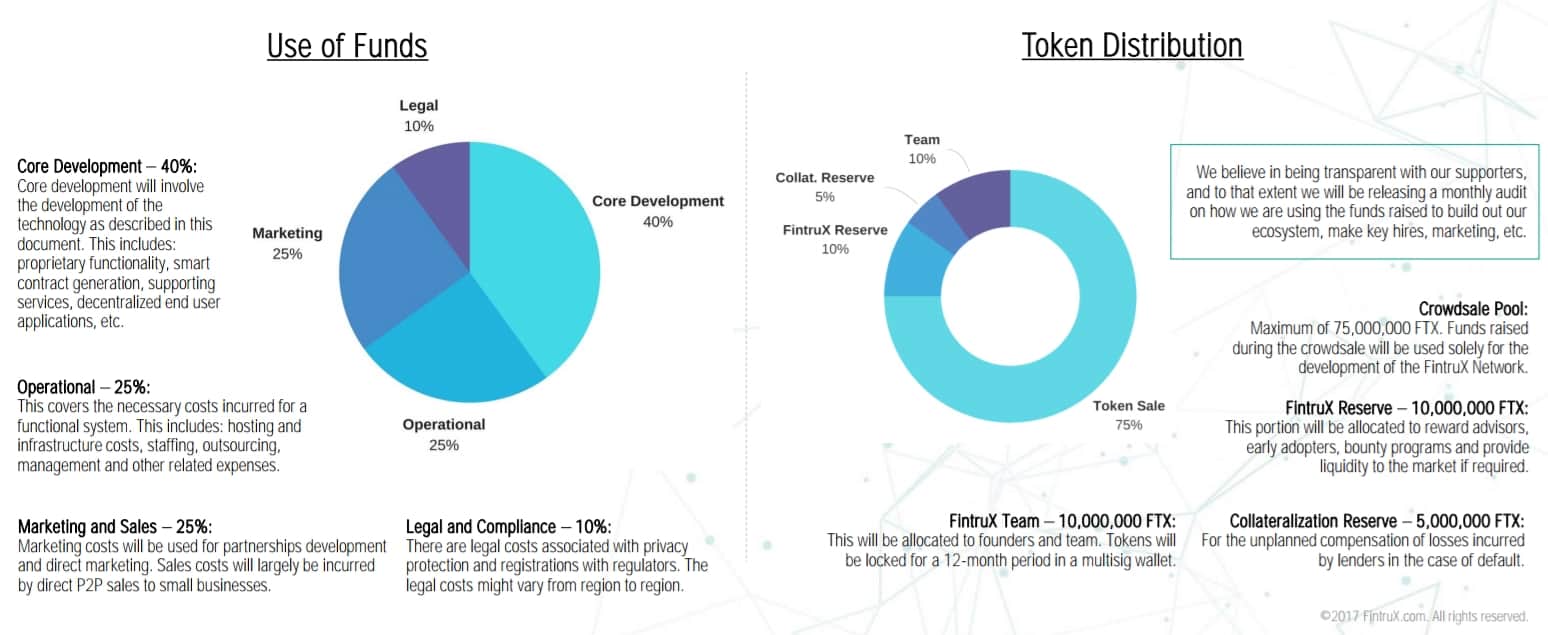

LEVEL 4: FintruX Reserve

Last resort protection

5% of all FTX Tokens have been reserved to cover any unexpected losses in the unlikely event that all previous credit enhancers fail. This is the ultimate protection.

No-Code Development

A unique smart contract is automatically generated and deployed by FintruX Network for each approved loan in real-time to provide unambiguous, immutable, and censorship resistant records where no arbitration is required. This is possible with our no-code development technology.

FintruX Network is one of the world’s first decentralized applications powered by Ethereum and no-code development. The FintruX Network architecture is a highly scalable and robust combination of the latest technological advances in blockchain, user-experience, client, and server-side methodologies.

Traditional automation attempts to use one system to account for any possible transaction. The resulting program has millions of “if-then-else” statements and is very complicated. We are shifting the programming paradigm with FintruX Network. We generate one unique program (“Smart Contract”) for each borrower contract to be deployed in real-time on the blockchain via a configurable interface.

By generating a new contract for each individual use case, each program is in its simplest form, eliminating the need for complex if-then-else statements. The Smart Contract becomes a binding agreement between the participants - unambiguous, immutable and no arbitration is required. Each borrower contract will be open-source, enabling participants in every loan to fully understand the terms of their loan agreement.

Open Ecosystem

In addition to simplifying the loan application process via instant matching, FintruX Network also provides borrowers with post-funding self-serve administration options and access to third party rated agencies.

Partners such as fraud and identity service agents, credit scoring and decision agents, wallets, exchanges, banks, asset managers, insurance companies and technology companies will all have a role in our ecosystem. Our network will enable our partners to offer a new generation of financial products and to develop innovative new tools for use on our platform.

We provide and maintain a decentralized review platform for borrowers, lenders and all service agencies based on Ethereum smart contracts. In contrast, reviews written on a third-party website are subject to change by the site owner – there is no integrity in the current non-blockchain based systems. The need of gaining qualified feedback/market research data to enhance the quality of risk assessment, service and transparency cannot be over-emphasized.

On the other side, we see borrowers, lacking a reliable source of comparability between different lenders as well as the possibility to give unfiltered feedback to share their opinion and thoughts. The same for lenders who can now rate and write reviews on their borrowers and agencies; subsequently these can be used as part of the credit scoring mechanism for assessment of credit risk.

The Token Economy

The FTX Token is used to power the FintruX Network and works as a means to reward or get rewarded for participation in the marketplace.

- Supply

Agencies, guarantors, and FintruX Network are all being paid in FTX Token.

- Demand

Borrowers and lenders pay a transactional fee in FTX to use the platform.

- Accessible

There is no upfront cost necessary for any of the participants on our platform.

Our Steps For Success

FintruX Network leads the way towards credit democratization, offering an innovative alternative to credit access.

- CREDIT ENHANCED FINANCING

Using the credit enhancement principles of securitization, FintruX delivers highly secure unsecured loans to benefit the small businesses borrowers, accredited investors, and financial institutions of the world.

- ONE WORLD

By partnering with wallets, exchanges, and regulatory bodies, FintruX enables small business borrowers from countries with high interest rates to benefit from loans offered by lenders located in lower rate countries.

- ADDITIONAL LOAN TYPES

FintruX invites innovative asset classes created by other network partners to the ecosystem to become the go-to financing hub of the world. FintruX will provide a marketplace for lenders to trade their loans to one another.

Contact Us :

WHITE PAPER : https://www.fintrux.com/home/doc/whitepaper.pdf

TELEGRAM : https://t.me/FintruX

TWITTER : https://www.twitter.com/fintrux

FACEBOOK : https://www.facebook.com/fintrux

GITTER : https://gitter.im/FintruX

Author : catur123

Eth : 0x6b85eA6ed28A887798D75DE9c4Db61479422C9E9

Tidak ada komentar:

Posting Komentar